As the final echoes of New Year’s Eve faded, my family and I stood on the brink of a year that would redefine our financial landscape. Beyond the customary resolutions, we pledged to reshape our financial future, setting a lofty yet concrete goal: achieve financial independence and live by the 3% rule. However, little did we anticipate that the pages of 2020 would unfold into a narrative marked by challenges and triumphs.

Just two months into the new year, we embraced the opportunity to turn our aspirations into action. Armed with $170,000 in hand and a strategic plan, we embarked on an investment journey that felt akin to setting sail on a serene sea—unaware of the tempest brewing on the horizon. The world shifted dramatically as the COVID-19 pandemic emerged, and our financial voyage abruptly transformed into a turbulent odyssey through unpredictable seas.

The pandemic storm tested the mettle of our investment portfolio, challenging its resilience. The markets, once predictable, became tempestuous, and we found ourselves navigating through economic uncertainties. Drawing on the lessons of past financial tempests, we resolved to stay the course. In the midst of the storm, our monthly contributions became the anchor, providing stability and direction.

“It is not the strongest of the species that survive, nor the most intelligent, but the one most responsive to change.” – Charles Darwin

With each bank transfer, well-meaning advisors cautioned us about the collapsing market, questioning our decisions. “Are you sure, now is not the time?” they wondered. Undeterred, we smiled—a gesture not born of ignorance but of determination. We comprehended the risks, acknowledged the challenges, and pressed forward, confident in our ability to weather the financial storm.

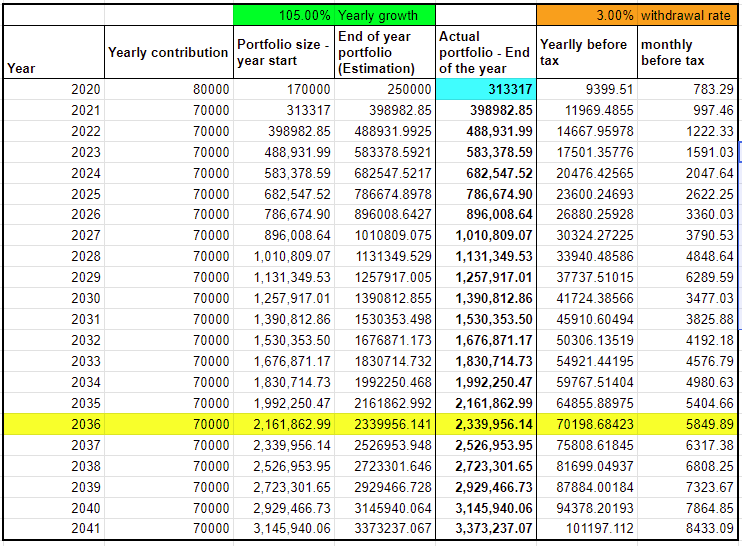

Throughout the tumultuous year, our commitment to our financial journey remained steadfast. We continued to inject funds into our investment vessel, reaching an estimated total contribution of $250,000 by the end of 2020. In the face of economic unpredictability, strategic decisions shaped our path. Allocating 75% to index funds and reserving 25% in cash and bonds represented our deliberate efforts to balance risk and stability in uncertain waters.

“Risk comes from not knowing what you’re doing.” – Warren Buffett

As the year drew to a close, our financial vessel sailed into calmer seas, and our investment account stood at $313,000. Beyond being mere numbers on a statement, they represented the progress made in the face of adversity. Each rise and fall, a testament to our resilience and strategic decision-making.

Financial Planning, Investment Strategy, Financial Independence

Looking ahead, our financial aspirations extend beyond immediate challenges. Through meticulous calculations, factoring in our spending rate, inflation, and the 3% rule (after taxes), we envisioned the possibility of retiring by 2035—before turning 50. This audacious goal, a beacon on the distant horizon, will be explored in-depth in future posts.

“Your time is limited, don’t waste it living someone else’s life.” – Steve Jobs

As we reflect on our 2020 financial odyssey, we recognize that this is an ongoing saga. Each trial and triumph contributes to the narrative of our pursuit of financial freedom. The journey is unfinished, and we invite you to join us as we navigate the seas of uncertainty, learning, adapting, and charting our course toward a more secure financial future. The best is yet to come, and we’re excited to share the unfolding chapters with you.